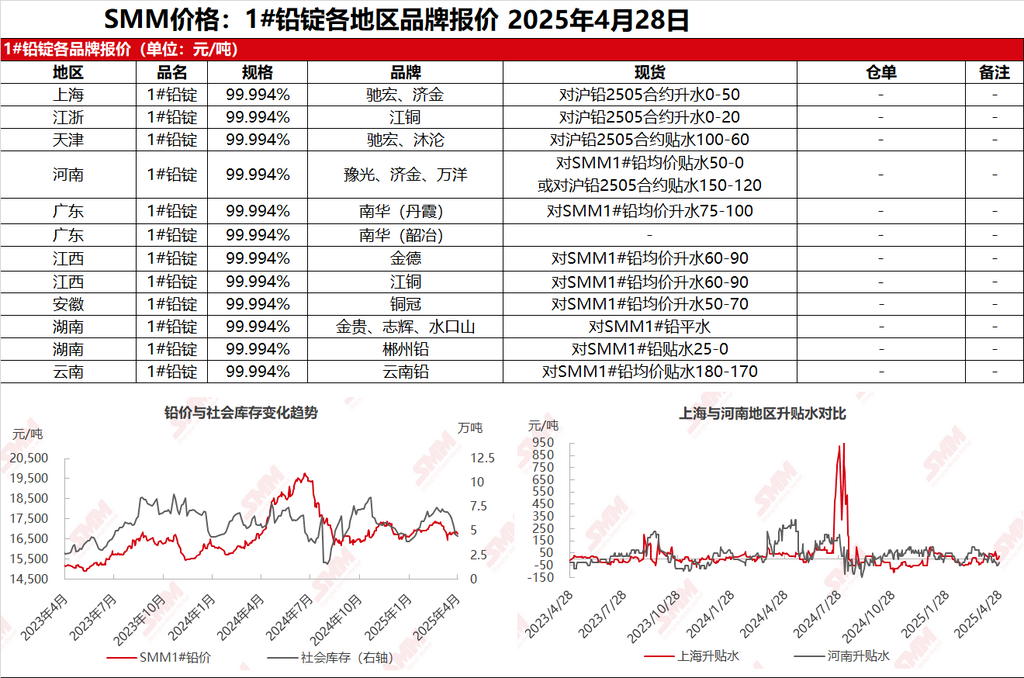

SMM News on April 28: In the Shanghai market, Chihong lead was quoted at 16,930-17,000 yuan/mt, with premiums of 50-80 yuan/mt against the SHFE lead 2505 contract. Jijin lead was quoted at 16,880-16,945 yuan/mt, with premiums of 0-20 yuan/mt against the SHFE lead 2505 contract. In the Jiangsu-Zhejiang region, JCC lead was quoted at 16,880-16,945 yuan/mt, with premiums of 0-20 yuan/mt against the SHFE lead 2505 contract. After the SHFE lead price surged and then pulled back, suppliers stood firm on quotes and sold their cargoes, with quoted premiums increasing compared to last Friday. Meanwhile, the discounts for cargoes self-picked up from primary lead smelters narrowed (against the SHFE lead 2505 contract). In the secondary lead sector, due to production cuts, the availability of secondary refined lead quotes was limited, with quotes at discounts of 50-0 yuan/mt against the SMM 1# lead average price, ex-factory. With the upcoming Labor Day holiday for downstream enterprises, they only maintained just-in-time procurement. Some enterprises that did not take a holiday purchased at lower prices, and there were still regional differences in market transactions.

Other markets: Today, the SMM 1# lead price fell by 100 yuan/mt compared to the previous trading day. In Henan, suppliers offered discounts of 150-120 yuan/mt against the SHFE lead 2505 contract, or quotes at 100 yuan/mt against the SHFE lead 2506 contract, with sluggish spot transactions. In Jiangxi, smelters offered premiums of 60-90 yuan/mt against the SMM 1# lead average price, ex-factory. In Hunan, smelters offered quotes on par with the SMM 1# lead average price, ex-factory, with downstream enterprises making just-in-time procurement. As Labor Day approaches, downstream enterprises have shown poor enthusiasm for pre-holiday inventory building. Some battery enterprises have taken an early holiday, and overall market transactions have remained sluggish.